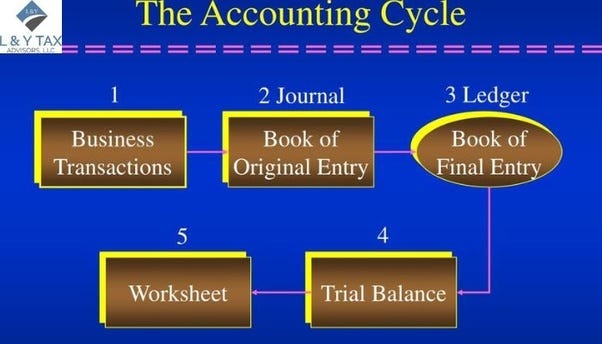

What is the 5 Step Accounting Cycle?

The 5 Step Accounting Cycle is a critical framework for organizing and managing a business’s financial transactions. This process ensures accuracy and consistency in financial reporting, enabling businesses to track their performance efficiently. In this article, L&Y Tax Advisor explains each step in detail.

1. Identify and Analyze Transactions

The first step in the accounting cycle is to identify and analyze all financial transactions. These transactions may include sales, purchases, expenses, or any other financial activity.

- Record every transaction to maintain a clear record.

- Classify each transaction based on its nature (e.g., revenue, expense).

For further insight, read more about this step on the L&Y Tax Advisor blog.

2. Journal Entries

After identifying the transactions, the next step is to record them as journal entries in the general ledger. This process ensures that each transaction is documented correctly.

- Debit and credit entries must be balanced.

- Double-entry accounting method is typically used for accuracy.

3. Posting to the Ledger

Once journal entries are made, they need to be transferred to the general ledger, which is a collection of all accounts used by the business.

- Classify transactions under specific account heads like cash, accounts receivable, or accounts payable.

- Ensure all amounts are accurately posted to avoid errors in financial reporting.

4. Prepare a Trial Balance

The trial balance is created to verify that all debits and credits are equal. This step helps detect any errors in the recording or posting of transactions.

- List all account balances from the ledger.

- Check if total debits equal total credits.

5. Prepare Financial Statements

The final step in the accounting cycle is preparing the financial statements: the balance sheet, income statement, and cash flow statement. These reports summarize the business’s financial performance and position.

- Balance sheet shows assets, liabilities, and equity.

- Income statement reveals profits or losses over a period.

- Cash flow statement tracks the inflow and outflow of cash.

By following the 5 Step Accounting Cycle, businesses ensure they maintain accurate financial records and comply with accounting standards. For more detailed information on the accounting cycle, visit L&Y Tax Advisor.

Read More:

Is sales tax included in car loan

Are gym memberships tax dedeectible for business

Comments

Post a Comment